Term insurance is the most important life insurance policy that we recommend to our clients. If you have bought a decent term insurance, then you probably don’t need any other life insurance policy. Here is a quick guide to buying the best term insurance.

Find how much term insurance can you buy

Usually companies will give a cover of 20-25 times of your gross income( in case of salaried) and about 10-15 times in case of self employed/business. For higher sums( 5 cr+) , it depends on case to case basis and is the final call is undertaken by the underwriting team of the insurer. Recently we had a client who was eligible for 13 cr term insurance, applied for 10 cr and got 7 cr cover!

Find how much term insurance premium can you easily pay on an annual basis.

I have seen many people discontinuing their premiums because after 2-3 years they suddenly find premiums to be too high and don’t see the value in paying them. After all a term insurance is not like a mutual fund which will grow in value as time passes! So choose a cover that you actually need and can easily pay for the next 30-35 years.

Choose the right duration for which you need cover.

I have seen many people go for very high duration covers. Many say that I need term insurance till 80! Here one should understand the point that term insurance is most needed between 30-60 years. This is the time when you are building your assets, your children are growing and your family is dependent on you for its finances. Post 60, you actually might not need a term insurance cover. For those who wish to cover their liabilities for a longer duration a cover up to 70-75 years is sufficient. So keep this simple and this should not be a big criteria to decide an insurer.

Avoid riders and extras

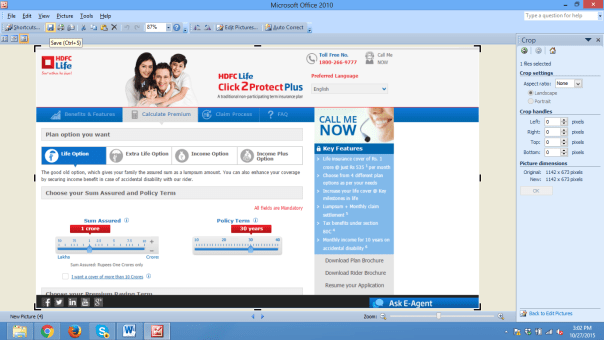

Insurers have this habit of complicating a simple product and they will keep on adding features to distinguish themselves from other players. This causes unnecessary confusion in the mind of the consumer. For example, take HDFC Life- first came Click2Protect, then click2protect plus and now click2protect 3D+. One can even expect 4D++ and 5D+++ in the future! Apart from an odd accidental death cover( if it is cheap), we recommend not to go with riders. Instead of buying that 2000 rs. rider, spend that money on buying extra cover if you can!

Compare premiums of online term insurance policies.

You don’t have to buy a term insurance policy from your broker as it will cost you about 20-30% higher. Always compare term insurance online and find plans that are the cheapest. You don’t want to pay a lot of money for a very simple product.

Compare claim settlement ratio of insurers.

Although IRDA has made it a rule that if you have paid regular premiums for 3 years, your policy can’t be rejected, I still recommend to go with players that have consistently high claim settlement ratio. At the same time, I won’t pay 30-40% higher for that policy. So anything that is cheap and above 95% should just work fine. As a matter of fact, claim rejection for 3 year+ policies is less than 0.1%.

Make correct declarations about your health and income.

I have seen many clients tempted to hide their health issues while filling up the online term plan proposal forms. Never do that. If you get a higher premium from one insurer , there are 10 others in the market. Giving wrong information is considered fraud and your claim is liable to be rejected. This defeats the whole purpose of buying a term insurance.

Choose a nominee and tell your family members about the policy.

Always choose a nominee for your policy and inform your family members about it so that they are aware of it. We have come across many clients whose families struggle to find the financial details of their deceased ones. As this is a product you are buying for your family, they need to know about it. They should know about the insurer, the cover you have taken and the duration of the insurance.Please note that the claim settlement process for an online policy is same as an offline policy.

Should you buy term plans with return of premium?

It refuses to amaze me how the insurance industry will try to complicate a simple product like a term plan. As Indians are not ready to pay for insurance and still view it is an investment, insurance companies have manufactured a product that comes with a return of premium at the end of the tenure? Isn’t this wonderful? So should one go for such plans? Lets do some simple math to find out:

I had a look at Aegon Religare’s return of premium plan for a 30 year old non smoker male for a sum assured of 1 crore. The premium comes around 23,000 per annum and the coverage is only available till 50 years. Compare this to a normal online term plan which will cost around 8000 for 30-35 years.

Now lets compare the so called “returns” of these 2 options:

In return of premium plan, you’d invest 23000 every year and get back your 4.6 lakhs at the end of year 20. One of biggest drawbacks is that you are not covered in your 50’s !

In the normal term plan, you’d pay 8000 and get 0% return on the same.Assume that you manage to get about 7% on the remaining 15000/annum for the next 20 years. So what do you get here. A back of envelop calculation shows that you’d get around 660,000 after 20 years! That gives you a saving of about 2 lakhs plus you get covered till 70!

Now most of the people can’t do this calculation and fall into the trap of “securing their money” and insurers are happy to give them such fancy products.

Our recommendation is always to go with simple term plan. Put rest of your money into good investment products that can get you 8-12% returns!

Are you still buying traditional insurance plans for investment?

I am still appalled to find many people still buying life insurance policies( especially endowment/single premium/money back) for the purpose of investment. When you are investing your money, you want to have returns that beat inflation for a longer period of time. When you are buying life insurance, you are doing so to protect your family against financial distress in case of your sudden death! The two objectives have nothing in common.

In India , financial advisors ( read insurance agents) sell these policies in name of tax saving,bonuses,long term returns etc. If you see the hard fats, most of such policies won’t yield you more than 5% in the long term. Let me give you an example:

Lets look at a benefit illustration of LIC Endowment Plan:

http://www.licindia.in/New_Endowment_Plan_benefits_illustration.html

As you can see, a 30 year old health male is paying about 2900 per Lakh of insurance. So what does the person get @4% returns- 2.4 lakhs. (don’t even bother to look at 8% returns as LIC bonuses range between 3-5%). Now when people sell you this policy, then 2.4 lakhs looks like a huge amount at maturity but actually you’d have actually put about 90,000 as investment in this plan and you won’t even double your investment in 35 years! ( The reason for the same is the fact that the bonus is not compounded and the bonus rates are too low- thats double whammy for any long term investment!). Also not to forget- you can’t sell your investments for 35 years(unless you are willing to take a loss on your investments for a surrender value)

Money back policies are even worst in terms of returns but play on the investor psychology of “getting his money back”.

Now look at the insurance bit- by paying 2900 per annum, you are getting a cover of just 1 lakh whereas a similar sum can buy you a 25-50 lakhs of term insurance cover! Get a quote here.

So next time when someone coaxes you to buy a traditional/endowment plan- ask him/her these hard questions. This might be a good time to take a fresh look at your insurance and investment portfolio. Also remember that money decisions are not to be taken based on emotions but based on data and your financial goals. You work hard for your money, let it work even harder for you.

Also see- Are Endowment plans any good for wealth creation?

Quick Review- Max Life Insurance Online term Plan

Riders on Term Insurance Plans

Riders in Insurance

IRDAI defines riders as “ add-on options (Benefits) that can be added to a basic Life Insurance Policy – to provide additional coverage”. Riders can help to customize your insurance policy based on your personal needs and coverage requirement. You can take riders at the time of taking the basic policy, however, some insurance companies allow to opt for them during the tenure of the policy. Riders come with a cost, so they increase the total premium to be paid on the policy. Some riders are in-built in the base policy, while others are offered as stand-alone from the base policy.

The premium paid on riders is added to the base premium of the policy and, thereby, it becomes eligible for deduction under section 80C.

There are several riders available on all types of insurance policies. Here, we will discuss the ones that are available on a term insurance plan and recommend which one should you take.

Term Insurance Riders

Term insurance is the purest form of insurance. That is, there is only death benefit – if the policyholder dies, the sum assured is given to the nominee. There are no maturity or survival benefits in terms of returns or bonus. When a term is bought with rider(s), the nominee gets an extra sum over and above the sum assured in case of policyholder’s death.

Let’s understand which riders a policyholder can opt with the a term insurance policy. A detailed know-how of these riders would help you to take a wise decision.

-

Accidental Death Benefit (ADB)

Under this rider, if the life insured dies in an accident, the nominee will get an additional amount, apart from the sum assured. Now, most term insurance buyers often think unless they take this rider, the nominee will not get the sum assured in the eventuality of policyholder’s death due to accident. Well, the fact is that term insurance covers accidental death, whether this rider is taken or not.

Here is an example. Shlok purchased a term insurance policy of Rs30 lakhs. His friend Ashok purchased the same policy for the same amount, but with an ADB rider of Rs10 lakhs. Now, in the unfortunate event of their death in a road accident, Shlok’s nominee will get only Rs30 lakhs while Ashok’s nominee will get Rs40 lakhs (Rs30 lakhs sum assured + Rs10 lakhs ADB amount).

-

Critical Illness Benefit (CIB)

This rider gives an additional amount (usually equal to sum assured) in case the life insured is diagnosed with a critical illness as specified in the policy document. Generally, most insurance companies cover cancer, heart attack, kidney failure, stroke, major organ failure, paralysis and Coronary Artery Bypass Graft Surgery (CABG), among a few others scope of critical illnesses.

CIB can be taken as a standalone rider or as an accelerated rider. In standalone CIB rider, when the life insured is diagnosed with a disease mentioned in the document, then a lump sum amount is paid to the life insured and the policy continues with the base sum assured or lesser coverage amount. In an accelerated CIB rider, the death benefit (even if the life insured is alive) is paid and the policy is terminated. So, when you are taking a CIB on your term policy, do ensure that you know whether you are opting for a standalone or an accelerated rider.

-

Disability Income Benefit (DIB)

The basic premise of term insurance plan is based on the fact that the sum assured is paid if and only the life insured dies. However, if a DIB rider is taken, the life insured will get a regular income from his policy in case he becomes disabled. Hence, this rider is also known as Partial and Permanent Disability rider.

This rider assumes that the life insured is no longer in physical capacity to earn due to disability which can be partial or total. The policyholder a fixed percentage of the sum assured at regular intervals for a fixed period of time to replace the loss of his income. Depending on the severity of disability, the policyholder may also get full sum assured as lumpsum and the policy will get terminated.

The definition of disability varies from one company to another. Please ensure you understand the definition before taking this rider.

Many insurance companies club this rider with ADB rider, so do your research properly.

-

Waiver of Premium (WOP)

If the life insured is diagnosed with a critical illness or becomes disabled, he might be in a position to pay future premiums as his regular income will cease to generate. The insurance company will waive of the payment of future premiums without changing the sum assured and other features of the policy. So, not only there is a waiver of premium during the survival of the life insured, there will be also death benefit for the nominee in case of life insured’s death.

We compared the riders offered on term plans by 14 life insurance companies. Surprisingly, only 7 insurance companies offer riders. Let’s take a look.

The term plan from Aegon Religare offers four riders:

- Critical illnesses benefit for cancer, open chest CABG, first heart attack and stroke

- Waiver of premium benefit on critical illnesses listed above

- Women critical illness benefit for women only.

- Disability income benefit where life insured becomes permanently disabled due to sickness or accident.

Even if you don’t take the critical illness rider, this term plan provides an in-built benefit on the diagnosis of any terminal illness, an amount equal to 25% of the base sum assured will be paid subject to maximum of `100 lakhs and the death benefit will be reduced by an amount equal to the benefit paid under this clause. No premium will be charged after company accepts the terminal illness claim.

The term plan from Bharti Axa offers two riders:

- Accidental death benefit

- Hospital cash benefit which allows payment of a fixed benefit for each day of hospitalisation. It also offers a fixed amount benefit if you are admitted in an Intensive Care Unit or a lumpsum benefit in case of surgery.

The term plan from HDFC Life offers two riders:

- Accidental death benefit

- Income benefit on accidental disability which offers monthly Income of 1% of the rider sum assured in the event of total permanent disability due to an accident for a fixed period of 10 years.

The term plan from ICICI Prudential offers three riders:

- Accidental death benefit

- Critical illness benefit

- Waiver of premium on permanent disability due to an accident

However, accidental death benefit and waiver of premium are in-built in the plan. There is another an in-built terminal illness benefit, which gives the death benefit on diagnosis of terminal illness. After the claim of this benefit, the policy terminates.

The term plan from Kotak offers two riders:

- Accidental death benefit

- Waiver of premium benefit in case of permanent disability.

The waiver of premium is in-built in the plan.

The term plan from Max Life offers one single rider:

- Comprehensive accident death benefit which provides additional protection benefit in the event of an accident, leading to an unfortunate dismemberment (listed impairments) or death. The benefits under this riderare payable over and above the base plan benefits.

The term plan from Max Life offers only one rider:

- Accidental death benefit

Comparison Chart

Which Rider is the Best for You?

The type of rider and the sum assured on the rider you take depends on your age, occupation, frequency of travel and medical history. Your financial capacity to pay extra premium over and above the base premium should also be taken into consideration.

We always recommend simple term plans with NO riders. For critical illness and accident coverage it might be prudent to compare the price of these riders with personal accident insurance as well as critical illness plans sold separately by many general insurers like Bajaj Allianz or Apollo Munich or HDFC Ergo.

Latest IRDA Claim Settlement Ratio in 2015-16 for life insurers

Updated- Some of the insurers have their data available for 2016-17( Till Sep 30,2016) and the same is being updated on our website. Check the same by getting a quote.

This data has been compiled from IRDA filings done by various insurers.

Here is the summary:

- Max Life has claim ratio of 96.2% for 2015-16 based on latest data available till March 31, 2016.Settled about 8895 claims worth 245 crores in 2015-16 with just 4 pending claims.

- HDFC Life has claim ratio of 95.02% for 2015-16 based on latest data available till March 31, 2016.Settled about 11811 claims worth 300 crores in 2015-16 with just 79 pending claims.

- Future Generali has a claim ratio of 90.5% for 2015-16. Settled 1416 claims worth 27 crores with 17 pending claims.

- ICICI PruLife has a claim ratio of 96.5% for 2015-16 having settled 12815 claims worth 399 cr with 44 pending claims

To compare premiums and past IRDA data( from 2011 to 2016) for all insurers, please get a quote now.

(Attaching a few screenshots for Max Life insurance from the website)

To see latest data for 2015-16(till March 31,2016) for other insurers like HDFC Life, SBI Life, Aegon, Aviva, Kotak,Edelweiss etc, get a quote below.

Top 10 Online Term Insurance Plans in 2015 – A Detailed Comparison of features and IRDA data

Compare Term Insurance Online

You have decided to get a term insurance cover to ensure your peace of mind and financial security for your family. Since you have already made this decision, we assume that you have conducted a detailed research on what are term insurance plans. If not, then we recommend you first browse through our complete guide to understanding and comparing term insurance plans online or understand it here.

Why do I need term insurance?

Imagine how your family will cope up with financial liabilities if you were to to die tomorrow or say in next 3 years. How would they pay the home loan or take care of basic family expenses? You should consider term insurance if you are concerned about how your family would manage in the event of your unexpected death.

How does term insurance work?

Term insurance pays out a fixed sum to your family on your death.

How much cover do I need?

The amount of insurance depends on your personal situation. Generally experts suggest a cash sum equal to ten times of your annual income.You might want a term cover just to cover your pending home loan or you want to cover for an amount that will cover your family�s future expenses including marriage of your children or their education. While you may decide to go a very high cover, you also need to consider your annual premiums. With term covers getting cheaper, one should go for a slightly higher covers.

There are several insurance companies offering online term insurance plans in India. We have chosen 10 insurance companies for comparison, based on their market reputation and number of online term plans sold.

- Aegon Religare

- Aviva

- Bajaj Allianz

- HDFC Life (Click here for quick overview on HDFC term plan)

- ICICI Prudential

- Kotak Life

- LIC

- Max Life (Click here for more details on Max Life term plan)

- PNB MetLife

- SBI Life

Compare Term Insurance Plans Online

We will do a detailed online term plan comparison based on the following parameters.

- Eligibility

- Riders and Premium Waiver- For details check Riders on term Insurance Plans

- Claim Settlement Ratio

- Solvency Ratio

- Premium Affordability

- Grievances Resolved

Parameter 1: Eligibility

Every insurance company has certain eligibility criteria to qualify a potential policyholder to invest in its online term plan. These eligibility criteria are mentioned in the table below.

The table below show comparison of term insurance companies eligibility criteria. As you may see, there is hardly any difference in the eligibility criteria across these insurance companies.

Parameter 2: Riders and Premium Waiver

A rider is a provision or a modification to an insurance policy that is purchased separately from the basic policy and that provides additional life cover and other benefits at an additional cost. These most popular riders in term insurance plans are accidental death, critical illness and hospitalization.

A waiver of premium is also a rider. It the policyholder dies, then the insurance company gives this premium waiver facility on the policy the nominee. That is, the policy continues and remains active, but the premium is paid by the insurance company till the end of the policy term.

Except Aviva, LIC and PNB MetLife, all other insurance companies provide accidental death benefit rider. Whereas, the premium waiver facility is available with only 6 of these companies.

Parameter 3: Claim Settlement Ratio

Claim settlement ratio refers to the total number of death claims settled by an insurance company. This calculation is done by dividing the total number of death claims received by the total number of death claims settled. For example, if an insurance company receives 1000 death claims and settles 900, the claim settlement ratio of that company would be 90%.

The higher the claim settlement ratio of the company, the better it is for online term plan buyers. It indicates that in the event of the unfortunate death of the policyholder, the probability of the nominee getting the sum assured is higher.

Now, you may see from the table below that LIC followed by Max Life and ICICI Prudential have been maintaining the most consistent claim settlement ratios since last two years. However, would you choose an online term plan from an insurance company just because it has the highest claim settlement ratio? For instance, LIC in this case? You shouldn’t. Read this article further to understand why.

(Source: IRDA Annual Report and Company Disclosures)

Parameter 4: Solvency Ratio

You may wonder what is solvency ratio and why you should consider it while choosing ans comparing online term insurance plan.

The solvency ratio of an insurance company is a measurement of its assets vs liabilities. It is the size of the capital of an insurance company against all risks undertaken by it. In simpler words, solvency ratio determines whether an insurance company has enough assets to meet its obligations in the long term. Is it financially strong enough to pay claims? Especially mass claims during natural or man-made disasters?

Currently, as per IRDA guidelines, insurance companies are required to maintain a minimum of 1.50 as the solvency ratio.

Among all insurance companies, Bajaj Allianz has the best solvency ratio, followed by Max Life.

(Source: IRDA Annual Report 2013-14)

Parameter 5: Premium Affordability

An insurance company may be reputed as well as have a good claim settlement and solvency ratio. But, does the price of the online term plan fit into your pocket? Online term plans are about 30 to 40% cheaper than offline plans. But the premium may drastically differ between online term plans of various companies. Let us compare term insurance premium online.

We have calculated premium for a 30 year old, non-smoking male for a sum assured of Rs50 lakhs for 30 years. Riders are not included in the calculation.

The table below shows that the premium of LIC is the highest, almost twice more than many other companies. So, if you were planning to choose LIC e-Term plan based on its highest settlement ratio, you may now want to change your mind!

Parameter 6: Grievance Resolved

You may be unhappy during your experience while or after buying an online term plan. You file a complaint with the concerned insurance company. The grievance redressal cell of an insurance company will look into your complaint and try to address it as early as possible. The quicker the process and higher the number of complaints resolved, better the grievance procedure is.

Below is the grievance resolved ratio based on the number of complaints. LIC tops here too with 100% resolution of complaints. So does Aviva. However, the number of complaints received by LIC is almost 20 times more than Aviva! Four other insurance companies – ICICI Prudential, Max Life, PNB MetLife and SBI Life have more than 99% grievance resolved ratio.

(Source: IRDA Complaints Data)

Top 5 Online Term Insurance Plans

Based on tabulations related to six parameters above, we have compared and ranked top five term insurance plans, 1 being the highest rank and 5 being the lowest rank.

- According to Claim Settlement Ratio

According to Solvency Ratio

According to Solvency Ratio

- According to Premium Affordability

- According to Grievance Ratio

So which is the best online term plan? Conclusion

- LIC has the highest claim settlement and grievance solved ratio. However, its term plan is the most expensive of all. Moreover, it just manages to meet the minimum solvency ratio as per IRDA guideline.

- Bajaj Allianz has the highest solvency ratio, 90% plus claim settlement ratio and 95% plus grievance solved ratio. You may choose its term plan, given that you can afford its premium which is the second costliest in the market after LIC.

- Kotak Life offers the cheapest term plan. It also has a good solvency ratio and grievance solved ratio. But, its claim settlement ratio is under the gold standard of 95%.

- Aviva online term insurance plan would have made a good choice, given its premium affordability, high solvency ratio and grievance resolved ratio. But, its claim settlement ratio performance is disappointing.

- Our vote goes to MaxLife Online Term Plan. It is the only insurance company which has been ranked among top 5 in each of the four parameters – claim settlement ratio, solvency ratio, premium affordability and grievance resolved ratio.

You can decide to take life cover from one or more company after the online term plan comparison. Each online term plan listed above has its own features and benefits to suit and customize your requirements. But, do remember that these statistics should not be the sole criteria to choose the right online term plan. Make sure whichever plan you choose should also meet your investment goal and financial needs in the long run.

Life Insurance Claim Settlement Process – Why claims get rejected and All You Should Know

Life Insurance Claim Settlement

The very purpose of a life insurance policy is to secure the breadwinner’s life and his family’s future. Life insurance gives cash benefits to the policyholder during his critical life milestones such as child’s higher education and marriage, health care emergencies and retirement or after the event of his unfortunate death. The benefit(s) received from the purchase of a life insurance policy in return of the premiums paid is called a claim. There are three types of life insurance claims:

1. Death Claim

2. Maturity Claim

3. Rider Claim

This article is divided into five sections to help you understand claims and settlement process.

Section 1: Reasons for claim rejection

Section 2: Understanding claim settlement ratio

Section 3: Claim settlement process – death, maturity and riders

Section 4: Online claim settlement – is it available?

Section 5: Claim settlement promises of insurance companies

Section 6: FAQs

SECTION 1: REASONS FOR CLAIM REJECTION

Just imagine if the insurance company refuses to pay either of the above claims! It could be a nightmare for you and / or your family.

You have waited your lifetime to get principal amount plus bonus of the insurance policy, but you don’t receive it. You are critically ill and waiting for amount due on the critical illness rider, but the insurance company refuses to pay. Your family wants to claim the death benefit after your sad demise, but the insurance company denies it.

Should You Always Blame the Insurance Company?

As per the insurance contract, insurance companies are under an obligation to pay the claims. But, then there are certain terms and conditions attached to this payment, which, if overlooked at the time of taking the policy, could prove a fatal mistake during the claim settlement process. While maturity and rider claims are comparatively less hassle-free to receive and chances of rejection are very low, it is the possibility of death claim denials which worries a potential insurance buyer the most.

However, statistics (IRDA June 2015 Journal) reveal that death claim settlement ratio of private sector is hovering around average 89% for the last 3 years, while for that public sector (comprising only LIC) has been consistently more than 95%. This means that out of every 100 death claims made in the last 3 years, private insurers have rejected only 11 cases while LIC has rejected between 1-5 cases.

Hence, it would be incorrect to say that insurance companies do not pay claims. They mostly do, but it is also equally important to know why they don’t do in some cases.

So, Why Claims are Rejected?

A large number of rejected claims are a result of either deliberate or unintentional slip ups on the part of the policy holder. Let’s see a few such reasons of claim rejection.

1. Not furnishing correct information about your age, income, occupation and number of dependents.

2. Not revealing the facts about your medical condition such as any prior diseases or family health history.

3. Not disclosing your lifestyle habits such as smoking or drinking, if you have one. Or, even if you do disclose, you may not be completely honest about the number of cigarettes you smoke or the quantity / frequency of alcohol consumption.

4. Not nominating the beneficiary or not furnishing the correct nominee details could also result in claim rejection.

5. Not paying premiums by due date or within grace period could lead to policy lapse. A claim on a lapsed policy is not valid.

6. Not declaring your previous policy details, if any.

It is advisable to be completely honest about the material facts and also understand all terms and conditions at the time of buying a policy.

You should also verify your personal information filled in the proposal form, especially if done so by an advisor, so that you can eliminate any errors.

After you receive the policy document, you must check that all your details are in order and the terms and conditions mentioned therein are satisfactory. If you find even a single spelling mistake in your name or incorrect mention of any other material fact, you should immediately notify the insurance company to rectify.

Early Death Claim Rejection

An insurance company might also reject an early death claim – that is, the policyholder dies within 3 years of taking the policy. This could be suicide, murder or a fraudulent death. Depending on case to case, the insurance companies undertake a detailed investigation, if they suspect a fraud, especially on discovering the material misrepresentation of the facts.

The Good News

The recent amendment in Section 45 of the Insurance Act 1938 seeks to reduce litigation over claims. According to this amendment, any policyholder can now be sure of payment of claims amount to his heir in case of his unfortunate demise if his life insurance policy has completed three years since inception or revival. The insurers, on the other hand, will have to upgrade their underwriting standards and skills to protect themselves against potential fraud.

The amendment also states that in case of fraud, the insurer must write to the claimant the basis of their considering the proposal or the claim as an attempt to defraud the company. The onus is now on the policyholders or the beneficiaries to prove that the misstatement or suppression of a fact was not done deliberately.

So, both the insured and insurer has to play their part honestly and carefully.

SECTION 2: UNDERSTANDING CLAIM SETTLEMENT RATIO

Claim settlement ratio refers to the total number of death claims settled by an insurance company. This calculation is done by dividing the total number of death claims received by the total number of death claims settled. For example, if an insurance company receives 1000 death claims and settles 950, the claim settlement ratio of that company would be 95%. The higher the claim settlement ratio of the company, the better it is for the insurance buyers. It indicates that in the event of the unfortunate death of the policyholder, the probability of the nominee getting the sum assured is higher.

A claim settlement ratio of 95% and above should be ideally taken as a benchmark while comparing insurance plans from different companies. Check here to see current and historical claim settlement ratio of insurers

SECTION 3: CLAIM SETTLEMENT PROCESS – DEATH, MATURITY AND RIDERS

A. DEATH CLAIM SETTLEMENT PROCESS

It is advisable that the claimant registers the claim at the earliest or at least during the claim intimation time (usually 60 to 90 days from the date of the death of the policyholder) as specified by the insurance company. The claimant can also take help of the insurance advisor who sold the policy to the policyholder.

The claim settlement process may slightly vary from one company to another. Here is how the claim settlement process usually works.

1. Intimate the claim: The claimant should contact the insurance company via email, phone, website or branch visit to give the claim intimation and understand the claim settlement formalities. The claimant is required to fill and submit the claim intimation form provided by the insurance company. This form typically contains the basic details like the policyholder name, claimant name, nominee details, policy number as well as date, reason and place of death.

Sample: Death Claim Application Form of Max Life Insurance

2. Submit the documents: The claimant would be required to submit the following mandatory documents to the insurance company.

• Claim form

• A copy of death certificate (never submit the original death certificate, you may require it later for other purposes)

• Original policy document

• Nominee’s photo identity and address proof

Apart from the above documents, the insurance company may ask for the following supporting documents, depending on the nature of the death of the policyholder and type of the case.

• Assignment / Re-assignment deed

• Legal evidence of title, in case the policy is not assigned or nominated

• Medical records at the time of death & past illnesses

• FIR, Police inquest report & panchanama

• Post mortem report

• Certificate from employer, hospital or any other authority as applicable.

• Any other document, as deemed necessary.

3. Settle the claim: The quicker and more precisely the claimant completes the formalities, faster the claim settlement process would be. As per the IRDA guidelines, it is mandatory for the insurance company to settle the claim within 30 days of the receipt of necessary documents and clarifications sought. If the insurance company feels the need for further investigation, it may do so. However, it is still obliged to settle the claim within 6 months from the date of claim intimation.

4. Payout: The claimant will receive the payout after the insurance company approves the claim. Please note as per an IRDA circular, the insurance payouts can be made only through electronic mode. In case the insurance company rejects the claim, communication regarding the same is sent to the claimant.

B. MATURIY CLAIM SETTLEMENT PROCESS

The payment by the life insurance company to the insured on the date of maturity term is called maturity payment which includes a sum assured and bonus/incentives, if any. The insurance company intimates the maturity date and amount to the policyholder through a blank discharge voucher, about 2-3 months in advance.

The policyholder has to furnish the information mentioned in the discharge voucher, sign it and submit it along with the original policy document to the insurance company. If the policyholder has assigned or reassigned the policy, then the relevant deed has to be submitted too.

Sample: Maturity Claim Discharge Voucher of SBI Life Insurance

C. RIDER CLAIM SETTLEMENT PROCESS

The rider claim settlement process depends on the type of the rider taken. At times, the settlement for riders like accidental death or premium waiver runs parallel with the death claim.

Documents Required

1. Critical Illness Rider

• Original policy document

• Claim form

• Hospital admission records

• Medical reports

• Discharge summary

• Any other as required by the insurance company

2. Accidental Disability Rider

• Original policy document

• Claim form

• Attested copy of FIR

• Medical records such as medicine bills and test reports

• Certificate of disability from doctor

• Photograph of the injured with reflecting disablement

3. Hospital Cash Rider

• Original policy document

• Claim form

• Medical records such as medicine bills, test reports and doctor’s prescription

• Hospital Discharge Card

SECTION 4: ONLINE CLAIM SETTLEMENT – IS IT AVAILABLE?

The communication between the claimant and the insurance company regarding intimation to payout / denial will mostly happen through emails, phones or / and letters. The claimant will require to pay a personal visit to the nearest branch of the insurance company at least once.

Whether the policy holder has purchased the policy online or offline, most insurance companies provide the online claim settlement facility with respect to following aspects only:

1. Claim Intimation – The claimant can visit the website of the insurance company and fill up an online form to intimate the claim. For submission of documents and further procedure, the claimant has to visit the nearest branch of the insurance company.

2. Claim Forms – The claimant can download the claim intimation form as well as various other claim related forms from the website of the insurance company. The duly filled forms can be submitted at the nearest branch of the insurance company for further procedure.

ICICI Prudential even has a facility to allow the claimant to upload the documents on its website.

3. Payout – If the claim request is approved, the claim payout will be directly credited to the claimant’s bank account

SECTION 5: CLAIM SETTLEMENT PROMISES OF INSURANCE COMPANIES

We visited the official websites of a few insurance companies to understand what they have to say about their death claim settlement process.

1. Max Life Insurance

• Fast settlement

“We will pay all death claims within 10 working days of receipt of all claim documents/ information. We shall pay interest @ 6% p.a. for any delays.”

• Claim assurance

“We ensure payment of all death claims for policies having completed 3 continuous years.”

• Advance account value payout

“We will pay fund value of all Unit Linked policies within two working days of claim Intimation.”

• Personalized assistance

We assign a dedicated Claims Relationship Officer for all death claims

2. LIC

Concessions for claims during the lapsed period

1. If the policyholder has paid premiums for atleast 3 full years and subsequently discontinued paying premiums, and in the event of death of the life assured within six months from the due date of the first unpaid premium, the policy money will be paid in full after deduction of the unpaid premiums, with interest upto date of the death.

2. If the policyholder has paid premiums for atleast 5 full years and subsequently discontinued paying premiums and in the event of death of the life assured within 12 months from the due date of first unpaid premium, the policy money will be paid in full after deducting the unpaid premiums, with interest upto date of the death.

SECTION 6: FAQs

1. Who is legally entitled to receive the death claim benefit?

The death claim is payable to the nominee of the deceased policy holder as mentioned in the policy document.

2. Who is legally entitled to receive the death claim benefit in case there is no nomination in the policy document?

It may be possible that the policy holder made the nomination, but the policy document is not updated with this information. Hence, it is advisable to contact the insurance company to confirm if the nomination details are missing or available in their records.

If there is no mention of the nomination or benefactor of the policy, then the claim is payable to the person who holds a Certificate of Succession or a legal evidence of title from a law court.

3. Whom can the claimant contact if he has any complaints regarding claims?

If there are any grievances such as a claim dispute or a delay in the settlement process, the claimant should approach the Grievance or Customer Complaints Cell of the insurance company. If the claimant does not get a satisfactory response to his grievance from the insurance company, he can approach the IRDA Grievance Cell and thereafter, Insurance Ombudsman if the grievance still remains unaddressed.

4. How to know the status of a claim?

The claimant will get a Claim ID, a kind of reference number against the claim submitted. The claimant can call up the customer care, visit the branch or check the status online using this Claim ID.

5. What if the claimant does not have a Claim ID?

Usually, every insurance company provides a Claim ID. The claimant must take note of this Claim ID. In case the Claim ID is lost, then the claimant can get a status update based on the policy number.

A life insurance claim if repudiated can be alarmingly disturbing the policyholder and / or his family. In order to ensure a hassle-free claim settlement process, it is in the best interest of the insurance buyer to be honest about his disclosures while taking a policy. Also, it is of the utmost importance the policyholder makes the nominee aware of his life insurance policy and also gives a fair idea of handling the claim settlement process.

The claim settlement process should not be a cause of worry, as long as these precautions are taken care of.

So go ahead and find the right term plan for your family by clicking here. Read all the data about insurers before taking the final decision. At the same time don’t delay this decision.

Your Complete Guide to Buying an Online Term Insurance Plan

Online Term Insurance Plan

With the internet becoming a routine of our life, the number of net-savvy insurance buyers is gradually increasing. Non-life insurance products such as personal accident, health, motor and travel have fuelled the growth of online insurance products. Now, while a similar trend is yet to gain substantial momentum in life insurance, online term insurance plan have been in particular gaining popularity. As per the statistics, one online term plan is bought every 5 minutes in India! The online quote systems and price comparisons on portals like trucompare facilitate the insurance buyers to buy a term plan easily and as best suited to their needs.

Aegon Religare was the first insurance provider to introduce an online term insurance plan called ‘i-Term’. Today, almost every insurance company from LIC to MaxLife insurance offer online term plans.

Now, if you are wondering if you should buy an online term insurance plan, how safe it is compared to an offline version and what is the process, here is a complete guide to simplify your decision.

Reasons to Buy Term Insurance Plan

- Convenient and Quick: One click, anywhere and anytime buying – that’s what an online term insurance plan is about.

- You can do term plan comparison – browse, research and compare the quotes, features and benefits of the online term insurance plans instantly across the websites of different insurance providers.

- You really don’t have to contact or follow up with any insurance advisor(s) or fear misselling of any kind.

- You can scan and submit the KYC documents.

- You can pay premiums by choosing any of the multiple payment methods available – credit card, debit card, net banking and even IVR (Interactive Voice Response).

- The policy is processed and issued quickly, so your life cover does not get delayed much.

- You can renew the policy online as and when the premium due or if it lapses.

- Cheaper Cost: The premium of online term insurance plans is about 30 – 40% cheaper than the offline plans. There is a misconception pertaining to economical cost of online term plans, though. Most customers believe that lower the premium, the higher is the probability of a claim rejection or that there is some catch. Well, that’s not true. There are several reasons why online term plans are more affordable. First, there is no agent commission or channel sales cost involved in the pricing. Second, insurers consider an online customer a low-risk profile – he is educated, earns well and prefers to take a life cover. Third, since an online transaction is paperless, the processing and administration cost also comes down significantly for the insurer.

- Transparent Process: One of the major problems that an offline insurance buyer faces is transparency – right from meeting(s) with the advisor to filling up the form. You usually rely on the advisor’s advice to understand the key offerings of the plan. There are also chances that your personal details could be misspelled or mentioned incorrectly in the physical form. Whereas, in an online plan, you would be doing all the formalities on your own. You have all the information at hand to make a sound decision. There is a step-by-step procedure to guide you, so the error rate is considerably low.

Drawbacks

- Lack of Human Touch: If you are someone who prefers the face-to-face support and advice for before (buying) and after (premium payment reminders, claim settlement, etc.) insurance, you may not be comfortable buying an online policy. However, you must also note that the most advisors do not stay for long with one single insurance company. So, if you think that the advisor who sold you policy will stay with you till the end of the policy term (unless he is someone who you know personally), you are mistaken! The good side is that you really don’t need an advisor’s help to buy an online term insurance plan for the reasons stated above. These days, insurance companies send automated text and email status updates / reminders for your policy. And to ensure that the claim settlement procedure is hassle free for the nominee(s), it is advisable to choose a reputed insurer with the best claim payout ratio.

- Insurance Lexicon: While applying for an online term plan, you may not understand the insurance wordings on the website. You may have to either dig up more information from the internet to comprehend their meaning or rely on the insurance provider’s customer support service.

Choosing the Right Online Term Plan

Now that you have decided to buy an online term insurance plan, the question is how to choose the right one. We have already written a detailed post on this earlier. Read here to know more.

Process

The process of buying an online term plan differs from one insurance company to another. However, the submission of personal details and KYC documentation remain same. As far as medical tests are concerned, you may have to undergo the same if the insurance provider deems necessary.

We will take examples of two insurance companies – Max Life Insurance and HDFC Life to explain the process of online purchase of term policies.

Max Life Insurance: When you log on to the Max Life Insurance website, you would be requested to fill your basic personal details like name, mobile number, email id, nationality and status. You will be then directed to a premium calculator page. You will need to fill your gender,date of birth, smoking status, sum assured required and policy term to arrive at the premium amount. The next page will take you to an online application form to fill personal details, contact details, previous policy details, health details and nominee details. Then, you will have to make the payment and upload the scanned copies of your KYC documents and any other document if required as per your plan. You will get a payment acknowledgement, which will act as your reference till the policy is issued to you.

HDFC Life: When you log on to HDFC Life website, you would be first requested to choose sum assured, policy term and premium paying term followed by your personal details such as age, gender and smoking habit. After your premium is calculated, the next page will take you to an online application form, which would cover more or less same details as any other insurance provider. On successful completion of the transaction, you will get an acknowledgement and further procedure of issuance will be undertaken.

Buying Tips

Buying online term insurance plans is reliable and safe as long as you chose the right insurer and the right plan. But, you should also keep a few important points in mind to ensure smooth processing of your application and effortless claim settlement process for the nominee(s).

- Understand the plan If required, consult your family, friends or an expert. You must also do term plan comparisons to make the right decision.

- If you are using a comparison site to seek information, you should verify the information for its relevance and freshness.

- Read all terms and conditions on the website carefully, especially the ones in the fine print.

- Do remember that most claim rejections result from non-disclosure, incorrect or misleading information. In order to ensure that the nominee(s) does not face any problem in the event of a claim, a precaution at your end while buying a plan is of the utmost importance. You must be honest about your disclosures. For example, you should mention your smoking or drinking habit. Or, if you have any previous life cover, that should be too declared. You may have to pay a higher premium, but it is worth your peace of mind.

- The browser page address line should show a secured connection. That is, it should start with ‘https’ instead of ‘http’.

- Before making a payment, ensure that the website has Secure Sockets Layer (SSL) certificate so that your transactions are safe and secure.

- Save the acknowledgement or reference number of the transaction, whether it was successful or unsuccessful. Ideally, keep a screenshot of the transaction page. This will act as a record till you receive the policy document by courier.

Post – Buying Tips

Your responsibility does not end after buying an online term plan. You have to consider following factors too.

- As soon as you receive the policy document, read it thoroughly to verify that your personal and policy details (sum assured, term, premium amount, etc.) are correct. You must also read the terms and conditions as well as exclusions.

- You have a right to return the policy to the insurer in the following circumstances.

- There is any mistake in your personal or policy details. The insurer will rectify and send a new policy document to you.

- There is a freelook period of 15 days from the date of receipt of the policy document. In case you are unsatisfied with the plan, you can return the policy document within this period and claim a refund of your initial premium.

- If the policy document is in order, show it to your spouse, parents, any other responsible family member or the nominee(s). Explain them the reason why you have bought a term plan and educate them on the features of the policy. You should also describe how a claim settlement process works and where and how to contact the insurer as and when such an unfortunate situation arises.

- Keep the policy document in a safe and a secure place. At the same time, it is also necessary that your family members or the nominee(s) know where it is kept and how to access it.

- Don’t forget to pay premiums on time! What’s the use of a term insurance policy if it lapses and can’t serve the benefits it was taken for? You have an option to renew the policy, however, the insurer may ask you to undergo a medical test. And, if the medical test reveals an unfavourable health condition, you may have to pay a higher premium or your policy may not get renewed. These are the reasons why timely payment of premiums is necessary.

Remember, that you are buying a term insurance plan for the financial security of your family. Online term plans are convenient and cheaper to buy. But, these alone should not be the decisive criteria. Choose an online term plan which meets your financial goals and gives you peace of mind.

IRDA Claim Settlement Ratio for 2015 – Compare best online term insurance plans

IRDA Claim Settlement Ratio for 2015

Update- We have updated the claim settlement ratios of online term insurance plans for 2014-15(based on IRDA annual report) and 2015-16 ( till Dec31, 2015 based on latest data submitted to IRDA by the insurers) on our website.

IRDA has just published its annual report for 2014-15 ,so we have compiled the claim settlement data for online term insurance plan providers in 2014-15 as well as for 2015-16 (till Dec31, 2015). We have also updated our online term plan comparison tables based on the same . This should allow you to choose the best online term plan for 2015 or make a switch if required. Here is the sample 2015-16 data for some insurers:

Check- IRDA Claim settlement ratio in 2016- Till Sep 30,2015

Check- Compare term plan tool to compare premiums and latest IRDA data of all term plans.

Here is some sample IRDA Claim Settlement data for 2014-15:

( 2Y+ rejects tells us about the number of claims rejected after paying 2 years of premiums)

Here is a summary of insurer data analyzed so far.

- Many insurers have improved upon their claim settlement ratios for 2014-15 from 2013-14. Some of the insurers like Aegon Religare have shown marked improvement for 2014-15 and 2015-16.

- Many good insurers like Max Life, ICICI Prulife, Birla Sunlife, Tata AIA etc. continue to improve their claim settlement ratios and are now around 95% mark which I consider as the gold standard. Based on latest 2015-16 data, Max Life continues to settle most of its claims within 30 days.

- LIC continues to rule the roost with a claim settlement ratio of closer to 99%! It is a pity that LIC still continues to sell online term plans at such an expensive rate.

- HDFC Life, SBI Life and Bharti Axa have shown a decline in their claim settlement ratios for 2014-15 and are now closer to or below 90%. For HDFC Life the decline has come primarily because of a lot of pending cases at the end of financial year.

I have always believed that what gets measured gets improved. As IRDA is forcing these insurers to declare these numbers publicly and the consumer is getting more aware about these, companies are making rapid progress.

Get a quick premium quote and you can compare all the IRDA claim ratios for all term plans for 2015 as well as or previous years. You can also check how they scored in last 4 years. For example, check the following Max Life historical charts:

Historical Claim Ratio of Max Life

As always it is important to do your research before buying any financial product. Don’t buy what is sold to you but what you need and what is actually good!

And as I always say- Never be lazy about buying a term plan. You will doing your family a great favour by buying one!